Company failures in India and throughout the globe, Pandey burdened, have taken place even the place formal compliances existed however moral substance was lacking, “the place governance failed, not as a result of guidelines had been absent, however as a result of braveness was.”

The Securities and Alternate Board of India (Sebi) chairman made these observations whereas talking on the World Discussion board of Accountants 2.0, organised by the Institute of Chartered Accountants of India (ICAI) in Larger Noida.

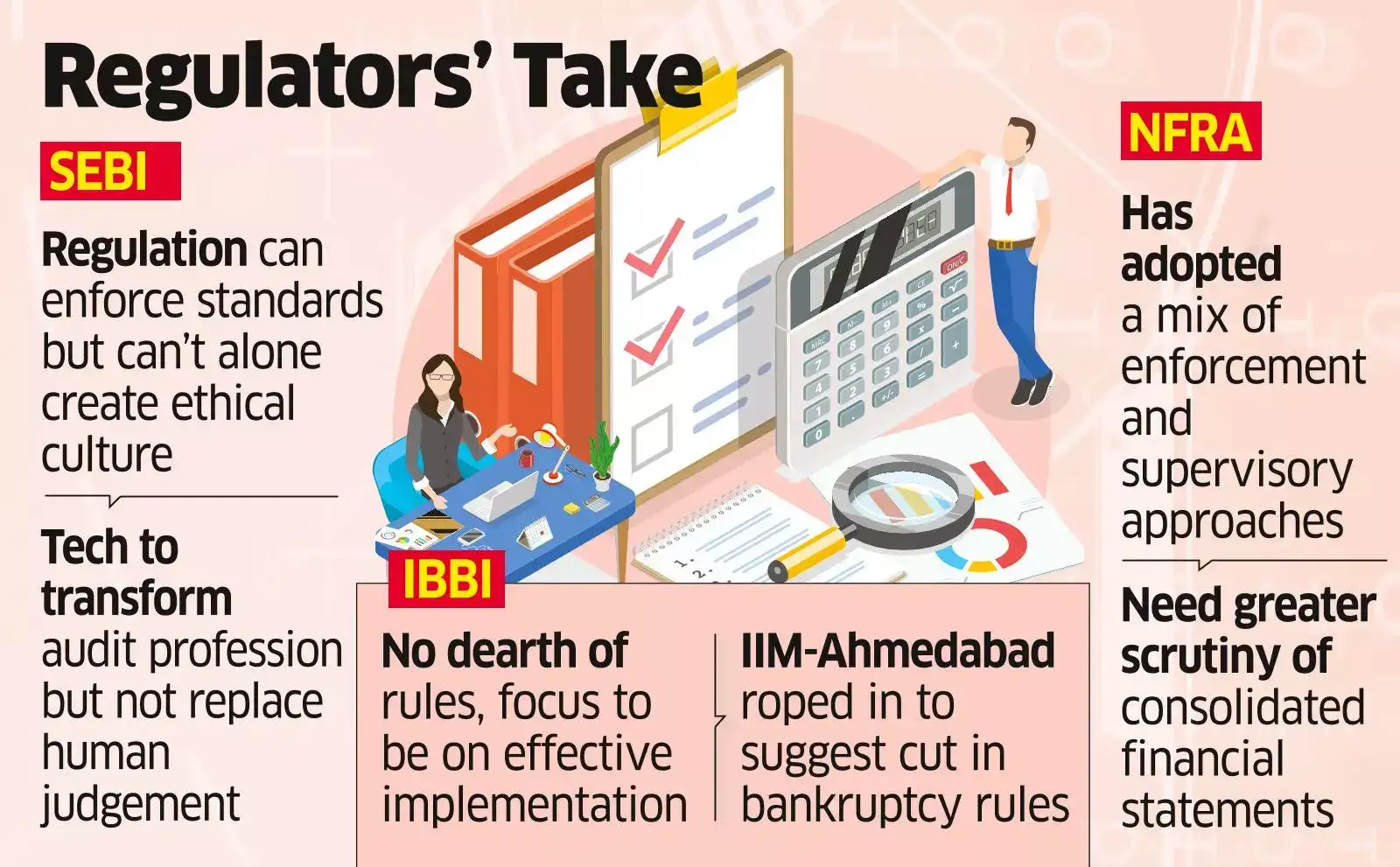

Nationwide Monetary Reporting Authority (NFRA) chief Nitin Gupta and Insolvency and Chapter Board of India (IBBI) chairman Ravi Mital, too, spoke on the occasion.

Companies

CompaniesSustaining Ideas

Mital pitched for reducing the variety of compliance necessities with out compromising on the effectiveness of laws or diluting company governance rules.

Moral judgement

Pandey stated the rising variety of preliminary public choices (IPOs)-320 in 2024-25 and 311 within the first 9 months of the present monetary year-signals that issuers more and more view Indian markets as able to offering scale, effectivity, and long-term capital. The spectacular progress of varied elements of India’s capital market additionally signifies rising stakeholder belief available in the market as an establishment.

Whereas watchdogs, together with Sebi, have been pursuing regulatory excellence, they continue to be acutely aware that monetary governance is as a lot formed by tradition because the compliance, Pandey stated. “The actual query is now not: ‘is that this technically permissible?’ It’s more and more: ‘is that this basically truthful? is that this clear? is that this within the public curiosity?'”

“These usually are not questions that regulation alone can reply. They’re questions that relaxation squarely on skilled conscience,” he added.

Many areas of the monetary ecosystem today-such as administration estimates, valuation subjectivity, advanced group constructions, ESG narratives, non-financial disclosures, and forward-looking statements-are not ruled by exact formulation. “They’re ruled by rules, by interpretation, by judgment. In such an surroundings, technical compliance alone is now not adequate,” Pandey stated.

Towards this backdrop, the position of chartered accountants additionally extends past simply getting ready or auditing monetary statements of firms; they should act as custodians of belief within the monetary system, Pandey stated.

Expertise and auditing

The rising adoption of new-age know-how, he underscored, will remodel the occupation however not change judgment.

Expertise will bolster audit high quality {and professional} effectivity.

“However know-how has its limits….It can’t change the human accountability to face agency when uncomfortable questions should be requested,” Pandey stated, highlighting the indispensability of steady upskilling, and reinvention of the accounting occupation.

‘Decrease compliance wants’

Pitching for lowering the variety of compliance necessities, IBBI’s Mital stated the insolvency watchdog has roped within the Indian Institute of Administration, Ahmedabad (IIMA) to take a look at chapter laws and recommend steps to scale back them the place essential to make compliances simpler.

There is no such thing as a dearth of legal guidelines and laws however what’s required is their more practical implementations, he stated.

Source link

#Fin #sector #stakeholders #technical #compliance #Sebi #chief