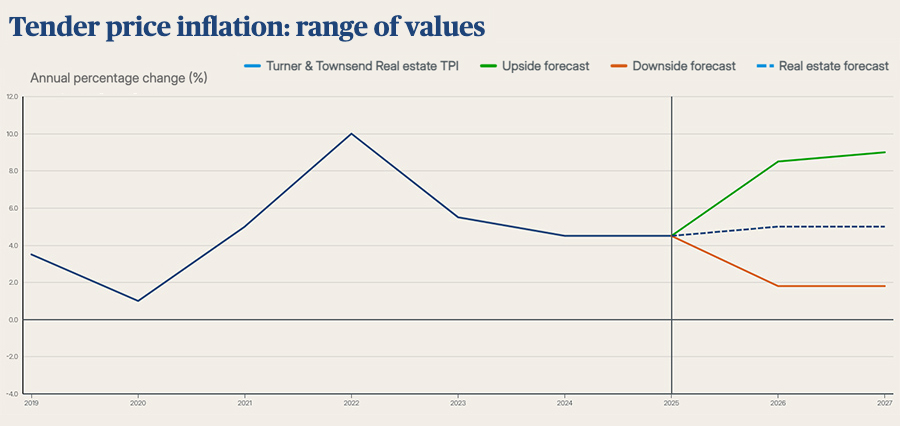

Development tender costs might rise by greater than 5% in 2026, threatening the fee and viability of main UK programmes. New evaluation from Turner & Townsend means that together with a tumbling buying supervisor’s index for the sector, there may very well be a coming crunch for the consulting sector as a complete.

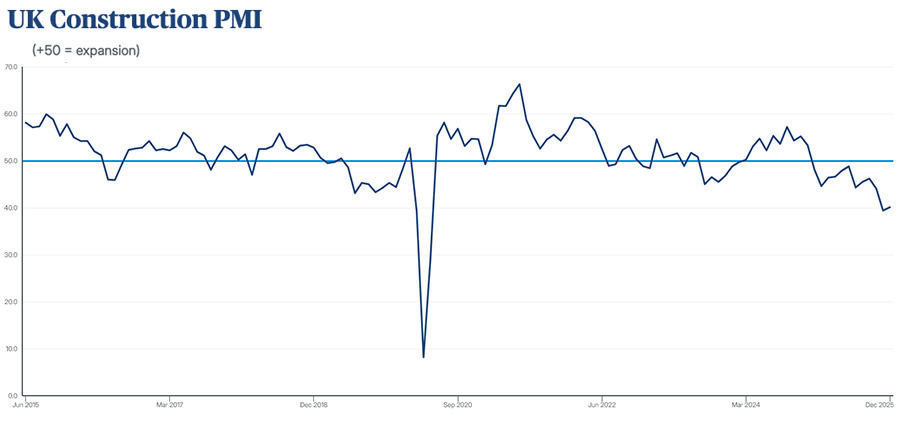

Inspecting December’s S&P Development PMI, Turner & Townsend discovered that it stays firmly under the 50.0 threshold, indicating continued contraction in workloads over the previous 12 months. Civil engineering was the weakest performing sector, whereas two subsectors (residential and business) recorded the sharpest drop in exercise since Could 2020, accompanied by vital declines in new orders and employment.

The survey’s respondents attributed the present outlook to weak market confidence and sluggish development on the pipeline. Nonetheless, wanting forward, corporations anticipating elevated exercise over the following 12 months barely outnumbered these predicting a decline. The UK’s long-term financial prospects, falling inflation and decrease borrowing prices have been seen as key drivers of the longer term workload.

Supply: Turner & Townsend

Stephanie Marshall, UK managing director of actual property value administration at Turner & Townsend, added, “It was an unsure closing quarter of final yr – from the chancellor’s funds to geopolitical tensions which have very a lot continued into 2026. It’s no shock then that shoppers stay nervous about committing to initiatives.”

Whereas this outlook might sound bleak, Marshall additionally famous that “the demand is there, each from private and non-private sectors, because the nation works to revive financial development”. Particularly, there are a selection of main programmes set out within the UK authorities’s spending evaluation, anticipated to return on-line within the subsequent 24 months – however within the meantime, “we are able to’t afford for the development sector to attend for the true capability crunch to hit.”

First, the sector must reckon with the truth that development tender costs are set to rise. Based on the researchers, it might carry by over 5% this yr, threatening prices for key UK programmes and difficult undertaking viability within the infrastructure section specifically – although that will probably be a decrease 3.5% in the true property sector. Whereas these each characterize solely a modest 0.5% carry from the TPI charges skilled final yr, sustained value escalation is placing stress on the viability of recent initiatives at a time of financial uncertainty.

Supply: Turner & Townsend

Marshall added, “Shoppers want to understand the nettle and get forward to make sure programmes get off the bottom and keep on observe. In right this moment’s advanced atmosphere of value inflation, capability challenges and regulatory reforms, shut monitoring of viability can’t be restricted to the procurement part or a single ‘go / no go’ second – it wants fixed evaluation all through the programme. Participating with the provision chain early and dealing with them as true companions, moderately than simply suppliers, may also assist in horizon scanning and addressing issues rapidly. There are vital alternatives dealing with our trade – to profit from these and ship for the broader UK financial system, we have to get the appropriate enterprise circumstances, fashions and expertise in place now.”

The UK has one of many highest charges of builder collapses within the G7, and a number of the worst fee occasions – leading to poor cash-flow all through the provision chain. Whereas bigger development corporations are working to protect working capital to take care of this, it’s particularly unhealthy information for the small companies who make up 98% of the development sector.

With a fall in output – the S&P International UK Development Buying Managers’ Index argued that November noticed output sink to its lowest stage since 2020 – and with Turner & Townsend forecasting tender costs are set to leap additional, a development crunch could also be on the horizon. In latest weeks, two giant development corporations have entered administration. Warwick Ward, a serious development plant seller, was positioned into administration in December after 55 years of buying and selling, adopted by Caldwell Development – which supplies groundworks companies for a number of nationwide housebuilders and employs greater than 400 folks – lower than a month later.

Source link

#Value #development #tenders #climb #warns #Turner #Townsend