Kearney has collaborated with the World Financial Discussion board, to analyse the methods provide chains are being threatened, and the way leaders are planning to adapt by bolstering resilience. The report was launched at a convention the place a lot of the dialogue centered on the sort of fragmentation it mentioned – as commerce struggle threats escalated over the way forward for Greenland.

Yearly, the second half of January sees the worldwide financial and political elite descend en masse on a Swiss ski-resort. The extraordinary annual migration of the world’s wealthiest and most influential people marks the commencing of the notorious World Financial Discussion board (WEF).

The agenda of the World Financial Discussion board is formed by the analysis and thought management of trade leaders. On the forefront of the occasion’s thought leaders are 100 strategic companions, an elite group of invitation-only companions chosen by the Discussion board. Amongst them this 12 months are Marsh – the skilled companies group behind names corresponding to administration consulting agency Kearney; an organization which has this 12 months debuted a paper inspecting the period of “structural volatility” which international provide chains at present face.

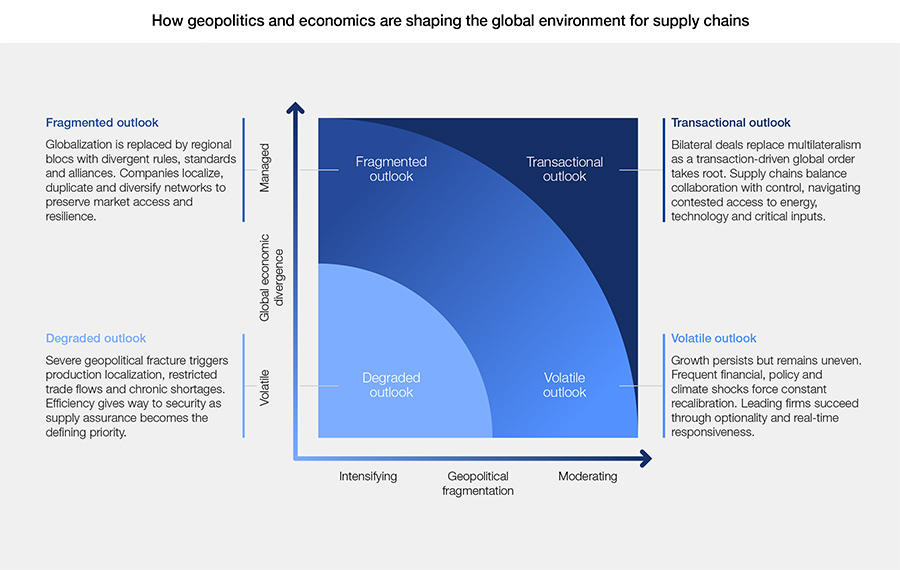

Supply: Kearney, World Financial Discussion board

In information which is unlikely to shock readers, the consultancy’s analysis highlights the “period of structural volatility” which so many different provide chain research have talked about lately. And with geopolitical fragmentation opening 2026 – with the US utilizing financial warfare to try to grab Greenland from its fellow NATO member Denmark, it actually looks like that period is right here to remain.

Amid this escalation, international provide chains discover themselves in a interval of large transformation. With enterprise leaders now prioritising investments in back-up plans for when new challenges emerge, 74% advised Kearney they’d began to view resilience as a driver of progress.

“Volatility is not a short lived disruption; it’s a structural situation leaders should plan for,” stated Kiva Allgood, managing director on the World Financial Discussion board. “Aggressive benefit now comes from foresight, optionality and ecosystem coordination. Firms and nations that construct these capabilities collectively will likely be finest positioned to draw funding, safe provide and maintain progress in an more and more fragmented international financial system.”

In line with a launch from Kearney and the WEF, the dimensions of the shift is “already evident”. In 2025 alone, tariff escalations between main economies reshuffled greater than $400 billion in international commerce flows, whereas greater than 3,000 new commerce and industrial coverage measures had been launched globally in 2025 alone – greater than 3 times the annual stage recorded a decade in the past. Collectively, these forces underscore why provide chain resilience has grow to be a central determinant of nationwide competitiveness and company technique.

Supply: Kearney, World Financial Discussion board

“Provide chain disruption in 2026 will likely be fixed and structural. Geopolitical fragmentation, shifting commerce guidelines and labour shortages are all redefining how worth is created and moved,” stated Per Kristian Hong, accomplice at Kearney.

“For provide leaders, the precedence is not forecasting disruption, however redesigning working fashions to operate underneath everlasting uncertainty. Meaning shifting away from efficiency-driven provide chains and in direction of adaptive networks that may be reconfigured with optionality as situations change.”

Source link

#provide #chains #coming into #everlasting #state #disruption