Planning for retirement isn’t nearly saving cash. It additionally contains placing a plan in place to make sure you don’t blow by means of that cash too rapidly when you save goodbye to the workforce.

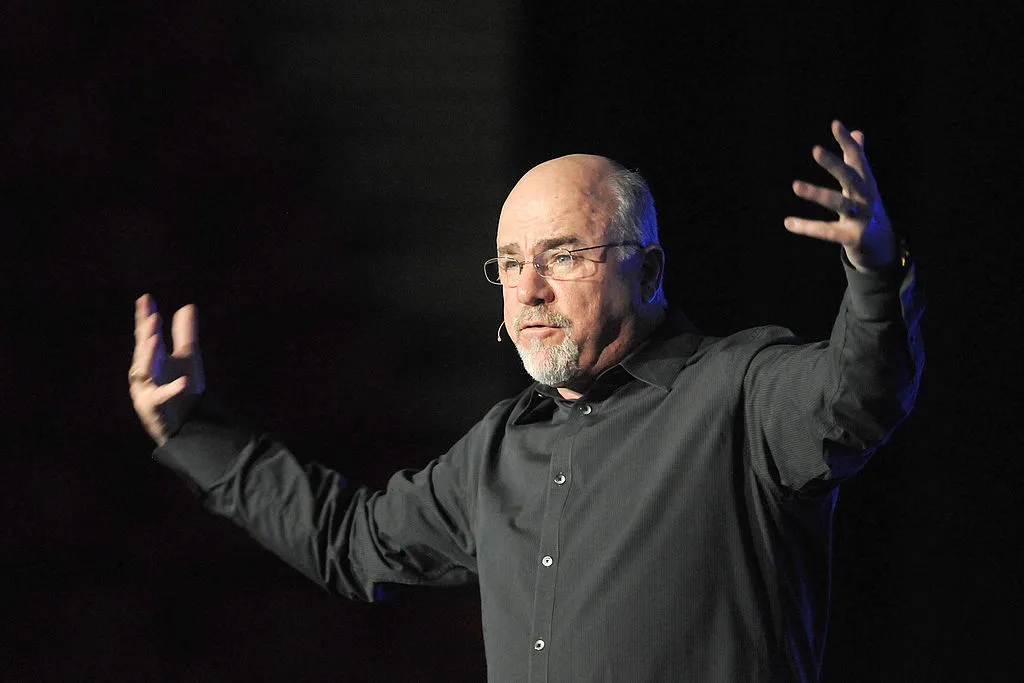

Private finance guru Dave Ramsey refers to every particular person because the CEO of their retirement. Growing sturdy cash habits as quickly as you possibly can will assist make sure that you don’t harm your retirement financial savings when you’re in your 50s, 60s and past. Listed below are three behaviors Ramsey says might set you again.

1. Treating debt funds as ‘regular’

Debt is usually a key piece of a monetary journey, corresponding to a mortgage to purchase a home or scholar loans to fund your schooling. However build up high-interest debt like bank card debt — and never specializing in paying off your debt typically — can chip away at your financial savings.

Ramsey may be very debt-averse. He says that folks ought to keep away from debt as a lot as attainable, and pay it off aggressively ought to they accrue it. Debt could make sense for some folks’s plans, however a bit of recommendation you possibly can glean from Ramsey’s strategy is to not view debt funds as only a regular a part of your price range. You should not get used to creating the funds a lot so that you just aren’t targeted on paying that debt off.

Ramsey believes folks ought to aggressively repay debt and that retiring with any of one of these debt can damage their golden years. He says one of the simplest ways to strategy debt you probably have it’s to pay it off as rapidly as attainable, and turn out to be debt-free earlier than retiring. That approach, you might have fewer bills to fret about and are extra ready for any surprises.

Gold Investor Equipment Provide: Join with American Hartford Gold right now and get a free investor package, plus obtain as much as $20,000 in free silver on qualifying purchases

2. Way of life creep with no written plan

Prices are likely to climb over time, however some retirees should still be shocked by rising bills that happen throughout their golden years. House upgrades, frequent journey and impulse spending can improve month-to-month bills in case you aren’t cautious, and a few folks spend a lot cash throughout retirement that their nest eggs get stretched too skinny.

Ramsey repeatedly suggests creating an in depth price range, dwelling under your means to keep away from way of life creep and avoiding reckless spending. Each unplanned greenback you spend is one other greenback that may’t work towards your retirement and compound in a portfolio.

Additional Cash: Stand up to $1,000 in inventory if you fund a brand new lively SoFi make investments account

3. Procrastinating your financial savings and having false confidence

Retirement planning is a long-term course of, and saving it for proper earlier than you’re able to step again from work can go away you financially weak deep into your golden years. Anticipating to rely solely on Social Safety with no technique for growing supplemental earnings, not maxing out your retirement accounts and getting deeper into debt can have penalties.

Ramsey says that saving for retirement shouldn’t be sophisticated, but it surely must be constant.

He suggests saving not less than 15% of your gross earnings — that’s, your earnings earlier than any taxes are taken out.

Save Smarter: Take management of your cash with the Rocket Cash budgeting app

Source link

#Dave #Ramsey #Warns #Cash #Habits #Damage #Retirement #Financial savings