Gold and silver are among the most frequently traded metals on commodity markets, with applications ranging from the automotive and aerospace industries to photovoltaic solar cells and semiconductors. The gold-silver ratio is the comparison of their prices, which has been used for centuries to measure the relative value between the two precious metals.

With increased industrial demand and the abandonment of the gold standard, the gold-silver ratio has experienced significant volatility since 1933. But investors can still use it as a hedging strategy to help identify opportunities for trading gold and silver. That’s because historically, precious metals have served as reliable portfolio hedges during periods of market volatility, economic downturns and recessions.

Read on to learn about the gold-silver ratio, its importance for investing, its limitations and how to best use it.

What is the gold-silver ratio?

The gold-silver ratio is the price of physical gold divided by the price of silver. It represents how many ounces of silver are needed to purchase one ounce of gold, and it fluctuates over time due to changes in the supply and demand of these precious metals.

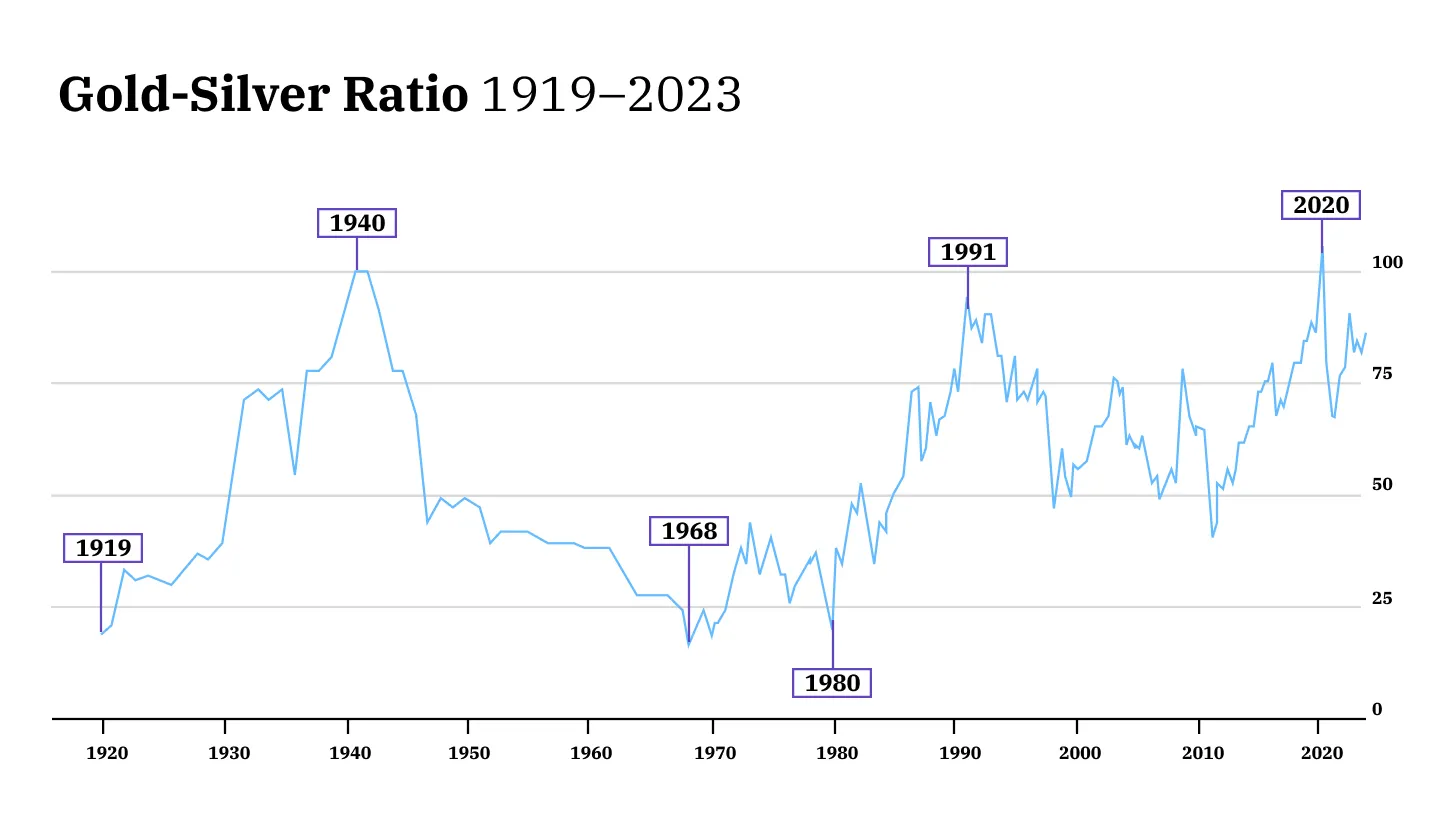

The ratio was first established during the Roman Empire at 12:1, meaning it took 12 ounces of silver to buy one single ounce of gold. Over the years, the ratio has adjusted alongside supply and demand of gold and silver. It reached an all-time high of around 125:1 in April 2020 coinciding with the arrival of the COVID-19 pandemic.

The gold-silver ratio has at times been fixed and at times been set by free market trade.

Why is the gold-silver ratio important for investing?

The gold-silver ratio can provide insights into the relative value of these metals and, along with other considerations, help traders decide whether to buy gold or silver. For example:

- When the ratio is high, it means silver is undervalued compared to gold.

- When the ratio is low, gold is undervalued compared to silver.

Accordingly, investors may be able to predict how the ratio will help them make trading decisions.

How to use the gold-silver ratio for trading

Analyze the history of the gold-silver ratio

Historical gold-silver analysis can help you understand how the ratio has behaved in the past — and may offer insights into how it will shift in the future.

The historical average gold-silver ratio is roughly 15:1, and the 100-year average is roughly 40:1. These figures are useful long-term averages that can help pinpoint the exit from silver to gold, or vice versa.

You can use charts and data to identify long-term and short-term trends, resistance levels and other important indicators that may help you make trading decisions about whether or not it’s the right time to invest in gold or silver. However, be sure to consider factors beyond what the ratio tells you before investing, such as:

- Central bank reserves

- The strength or weakness of the U.S. dollar

- Current levels of inflation

- Current interest rates

- Geopolitical unrest

To learn more, read our guide on what drives the price of precious metals.

Learn and monitor the ratio to recognize opportunities

Monitoring the gold-silver ratio to foresee how prices of the two metals are moving can help you make informed trading decisions. For example, you may trade gold for silver when the ratio is high and trade silver for gold when the ratio is low.

Over time, this can increase the amount of metal you own. However, it’s possible that the ratio will move further in the other direction, making it disadvantageous to trade. Remember to track profits and losses and adjust your trading strategy based on market conditions and your risk tolerance.

What are the limitations of using the gold-silver ratio?

Like with any other strategy, trading the gold-silver ratio comes with risk and should be done carefully.

The gold-silver ratio is affected by economic factors such as crude oil prices, stock market performance, global currency valuations and Treasury yields. These can impact the perceived value of gold and silver and, in turn, affect their ratio. Also, the ratio does not provide information about the absolute price of gold or silver, but only the relative value between the two.

In short, the gold-silver ratio shouldn’t be the only tool you use to make investment decisions about trading precious metals.

Trading strategies to consider

When it comes to precious metals trading, the gold-silver ratio constantly fluctuates, presenting various trading strategies for astute investors. Some of those trading strategies offer ways to potentially capitalize on price differentials, trend movements and overall market dynamics between the two metals.

- Mean reversion: A popular trading strategy focused on buying undervalued assets and selling overvalued ones, assuming that prices will eventually return to their historical averages. For example, you may choose to buy silver and sell gold when the ratio is high, or vice versa when it’s low.

- Momentum trading: A short-term strategy where traders buy or sell an asset based on its upward or downward trend in price. When using this strategy, you may buy gold after identifying the start of a potential uptrend in the ratio and sell when you start to see a downtrend.

- Hedging: A risk management strategy where traders take one position to protect themselves from potential losses in another position, reducing overall risk. Because precious metals can serve as hedges in times of economic uncertainty, using the gold-silver ratio may help insulate your portfolio from outsized losses.

- Pair trading: A pairs trade involves taking two positions in two different assets with similar characteristics. This allows you to take advantage of relative price movements between two assets. For example, traders betting that the gold-silver ratio will decrease could take a long position in gold and a short position in silver.

- Ratio spreads: Also called frontspreads, this is an options trading strategy that entails simultaneously holding unequal long and short options.This may suit traders who want to take a neutral position in the gold-silver ratio and profit from changes in the ratio without making a directional bet on either metal.

Gold-silver ratio FAQs

What is the history of the ratio of gold and silver?

The gold-silver ratio dates back to ancient times when it was used by the Greek, Roman and Byzantine civilizations. During the Roman Empire, the ratio was set at 12:1. During the Middle Ages, the ratio was used in Europe to determine the exchange rate between gold and silver coins.

The ratio has fluctuated dramatically since, ranging from 2:1 to over 100:1. It wasn’t until 1866 that it broke above 20:1 for the first time and has only briefly come below that mark twice, once in 1919 at the end of WWI and again in 1969 when President Nixon permanently severed the U.S. dollar’s link to gold.

What is the gold-silver ratio today?

So far this year, the gold-silver ratio has fluctuated between about 83:1 and 91:1 — meaning it has required between 83 ounces and 91 ounces of silver to buy one ounce of gold.

What does it mean when the gold-silver ratio rises?

A rising gold-silver ratio typically indicates the price of silver is falling faster than the price of gold. With a higher ratio, it means that silver is relatively less expensive compared to the price of gold.

Why is the ratio of gold to silver so important?

The ratio of gold to silver can provide insights into the relative value of the two precious metals. Traders can use the ratio to help determine whether gold or silver is overvalued or undervalued at current prices. This can help identify opportunities when used alongside other factors like technical indicators and trading strategies.

What factors can cause the gold-silver ratio to increase?

The gold-silver ratio may increase due to several factors, including economic conditions, supply and demand, mining production, currency fluctuations and investor sentiment..

Economic uncertainty, for example, can drive investors towards safe-haven assets such as gold, causing its price to increase relative to silver. And if industrial demand for silver increases while demand for gold remains flat, the ratio may decrease.

Summary of the gold-silver ratio

Throughout history, the gold-silver ratio has been influenced by factors such as supply and demand, changes in monetary policies and geopolitical events. Today, it remains a tool used by investors seeking potential trading opportunities with precious metals.

Monitoring the ratio’s fluctuations and its historical record while combining that with a strong trading strategy can help you recognize opportunities and make informed trading decisions. But while the gold-silver ratio is valuable, it is limited regarding absolute prices of gold and silver, meaning it shouldn’t be the sole basis for investment decisions.

Source link

#GoldSilver #Ratio