4 min learnMumbaiFeb 11, 2026 05:32 AM IST

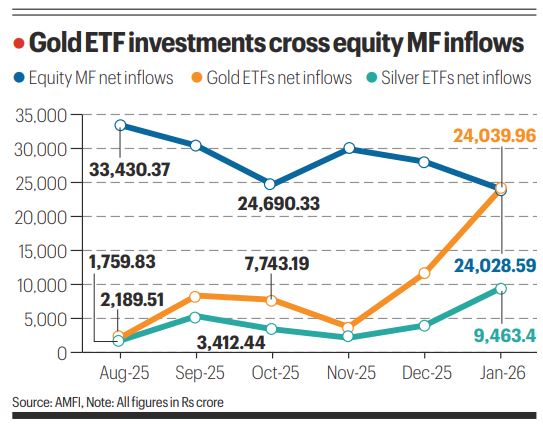

In a primary for India, investments in gold Trade Traded Funds (ETFs) in January have been larger than inflows into equity-oriented mutual funds, confirmed information from the Affiliation of Mutual Funds in India (AMFI) launched Tuesday.

This underscores the surge in demand for the yellow steel as an funding possibility, as gold costs proceed to hit new highs. In keeping with the AMFI information, inflows into gold ETFs — MFs that spend money on gold — greater than doubled in January from December 2025 to an all-time excessive of Rs 24,040 crore — a 3rd straight month-to-month rise as traders guess that costs will proceed to rise.

Gold costs have already doubled within the final one 12 months on safe-haven demand amid a weakening US greenback, strong shopping for from central banks globally, and a turbulent geoeconomic and geopolitical setting. Silver, which has seen its value rise at a fair quicker clip, noticed internet inflows into its ETFs amounting to Rs 9,463 crore, taking the entire property below administration (AUM) of those funds to Rs 1.17 lakh crore as on the finish of January. The AUM of gold ETFs stood at Rs 1.84 lakh crore.

In distinction, inflows into equity-oriented MFs fell for the third straight month in January, dropping 14% from December to Rs 24,029 crore. Whereas this displays the sobering efficiency of the fairness markets — the benchmark Nifty 50 fell round 3% in the course of the month — traders have additionally been diverting cash away from fairness MFs to gold ETFs. In comparison with January 2025, internet inflows into gold ETFs final month have been virtually seven occasions increased, whereas fairness inflows have been down 39%, in line with AMFI information.

Amongst equity-oriented funds, all however 4 classes noticed decrease internet inflows in January from December, with large- and mid-cap, mid-cap, small-cap, and flexi-cap funds all seeing over 20% decrease internet inflows. Massive-cap funds have been one of many few outliers, with inflows rising 28% to Rs 2,005 crore. Targeted and sectoral funds have been the opposite sequential gainers.

A Balasubramanian, MD & CEO, Aditya Birla Solar Life AMC Ltd, stated, “The latest rise in gold and silver has led to a pointy enhance in demand for gold and silver ETFs as traders search for totally different avenues to achieve publicity to treasured metals. Nevertheless, equities proceed to stay the popular asset class for funding from a long-term wealth creation perspective.”

The AUM of fairness funds stood at Rs 34.87 lakh crore as on January 31.

Story continues under this advert

On the entire, inflows via Systematic Funding Plans, or SIPs, have been unchanged in January at Rs 31,002 crore, whereas the variety of SIP accounts elevated to 10.29 crore from 10.11 crore in December.

At a time when overseas traders have pulled out to the tune of billions of {dollars} from Indian markets, purchases by home institutional traders comparable to mutual funds have been very important. In January, International Portfolio Traders (FPIs) internet offered almost Rs 36,000 crore — or $4 billion — of Indian equities. Nevertheless, they’ve returned in droves in February, snapping up greater than Rs 15,000 crore ($1.7 billion) price of shares to this point this month, buoyed by a turnaround in sentiment after the announcement of discount in US tariff on Indian items to 18% from 50%.

In 2025, FPIs had internet offered Indian equities price Rs 1.66 lakh crore, or virtually $19 billion.

Traders have additionally been shifting away from debt mutual funds. Whereas these funds noticed inflows of Rs 74,827 crore in January – up from a internet outflow of Rs 1.32 lakh crore in December 2025 – it was down 42 per cent from the year-ago determine of Rs 1.29 lakh crore.

Story continues under this advert

“The reversal largely displays submit year-end money redeployment as company and institutional traders reinvest surplus balances that have been briefly drawn down in December,” stated Nehal Meshram, senior analyst, Morningstar Funding Analysis India.

The restoration was overwhelmingly led by the liquidity phase. In a single day funds attracted Rs 46,280 crore, whereas liquid funds noticed Rs 30,682 crore of inflows. Cash market funds additionally gathered a wholesome Rs 12,763 crore, supported by engaging short-end carry and renewed parking demand.

Hybrid funds witnessed a surge of over 61 per cent to Rs 17,356 crore, as in opposition to Rs 10,756 crore a month earlier. The online AUM of debt funds was up 11 per cent year-on-year at Rs 18.9 lakh crore as on the finish of January.

Source link

#time #Indians #make investments #gold #ETFs #fairness #MFs