Artisan Companions Asset Administration Inc. (NYSE: APAM) reported sturdy efficiency in 2025. Belongings underneath administration grew almost 12% in the course of the yr. Artisan This fall 2025 earnings exceeded expectations because the asset administration agency reported report belongings underneath administration. The Milwaukee-based firm demonstrated momentum throughout all key metrics. For the official Artisan This fall 2025 earnings announcement, go to the investor relations web page.

Market Place and Asset Progress

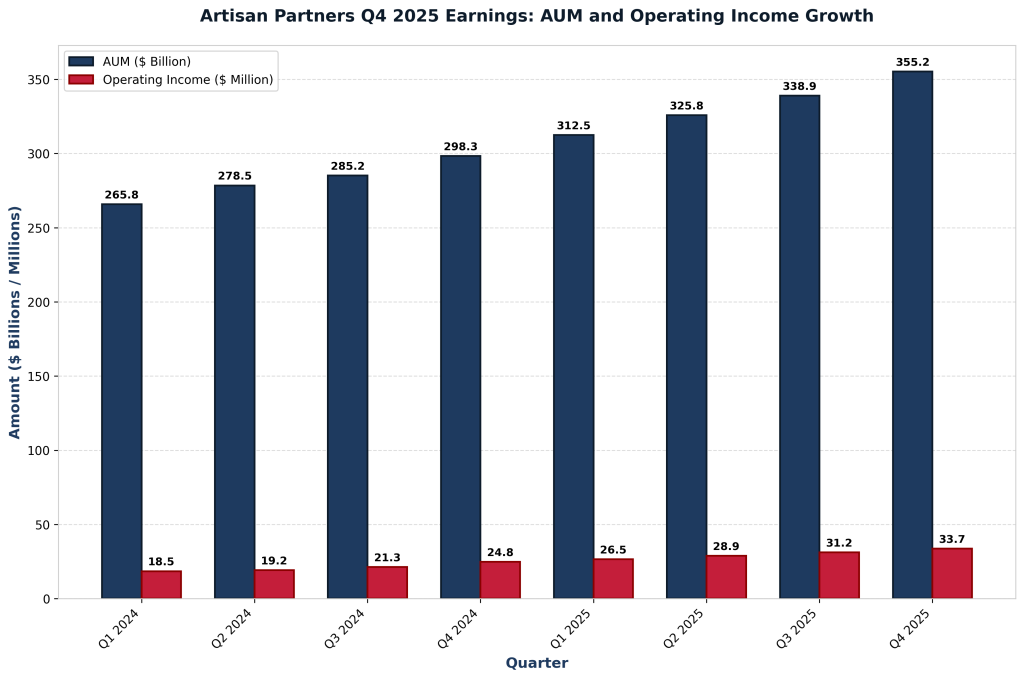

Artisan Companions stands as a number one multi-asset class funding platform. The agency manages belongings throughout world fairness, fastened earnings, and options methods. Belongings underneath administration reached $355.2 billion by year-end 2025. This represented almost 12% progress in comparison with 2024. The corporate’s diversified product choices attracted investor capital. Moreover, funding returns exceeded 20% internet of charges. For real-time market information on Artisan This fall 2025 earnings and inventory efficiency, go to Yahoo Finance APAM.

Artisan This fall 2025 Earnings: Fourth Quarter Outcomes

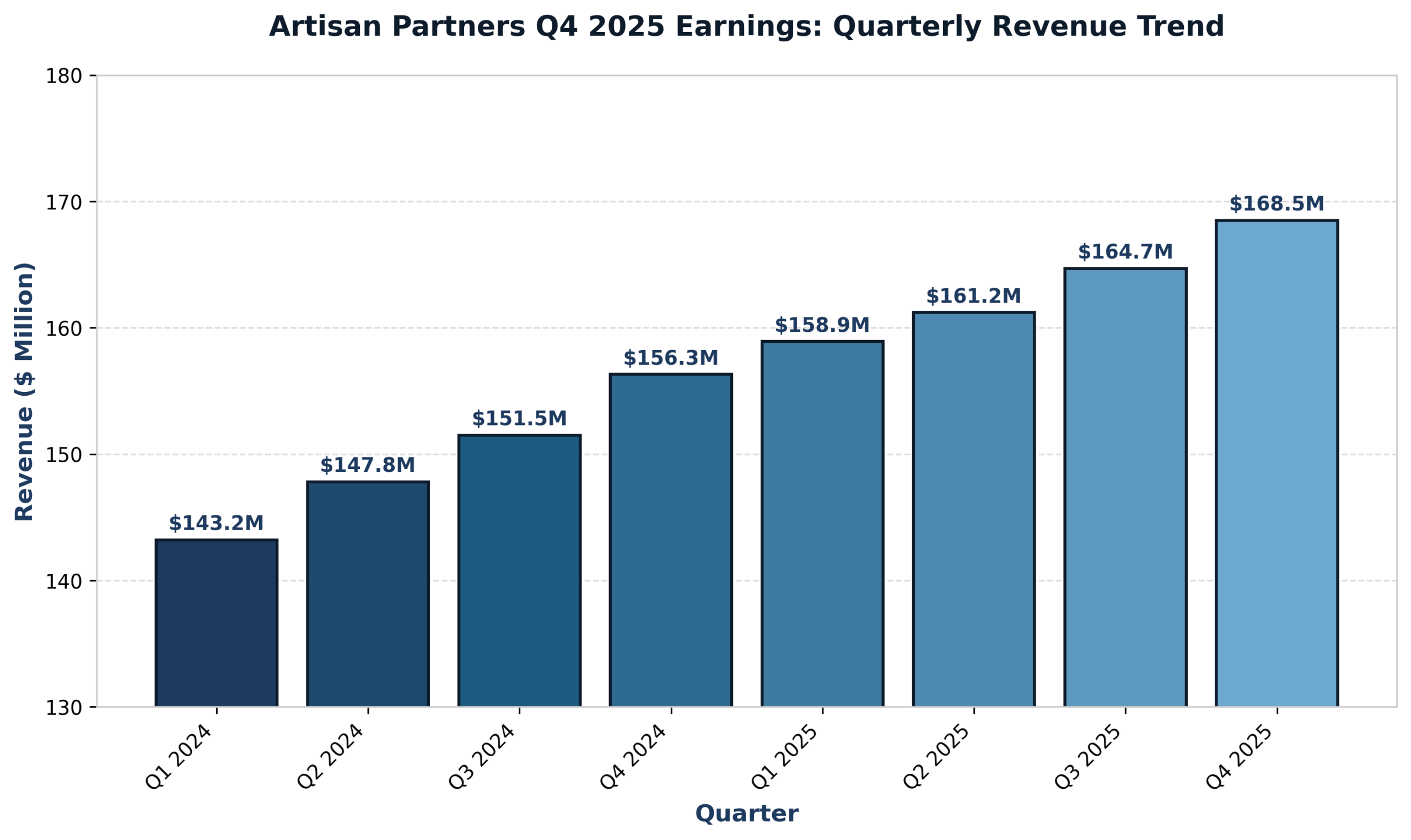

Fourth quarter income was $168.5 million. This mirrored 8% progress in comparison with full yr 2024 income efficiency. Working earnings elevated 9% year-over-year. In the meantime, adjusted working earnings expanded 12%. The agency generated vital absolute returns for purchasers. CEO Jason Gottlieb famous sturdy shopper engagement. Most significantly, the corporate continued increasing its multi-asset class platform. Particularly, Artisan introduced the acquisition of Grandview Companions. This actual property non-public fairness agency makes a speciality of industrial property origination and improvement.

2025 Full Yr Efficiency

Full yr 2025 income totaled $612.4 million. This represented strong progress from 2024 ranges. Working earnings reached $95.2 million. Adjusted working earnings exceeded $105.8 million. The agency achieved sturdy profitability regardless of market volatility. Most significantly, Artisan maintained its funding efficiency edge. Consumer satisfaction remained excessive all year long. Trying forward, administration expects continued momentum from new methods and acquisitions.

Quarterly Income Pattern

Artisan This fall 2025 Earnings: Quarterly Income Efficiency (2024-2025)

Strategic Progress and Acquisitions

Artisan Companions introduced a transformational acquisition in January 2026. Particularly, the agency acquired Grandview Companions. This addition strengthens Artisan’s options platform. The true property non-public fairness alternative matches the corporate’s technique. Moreover, Grandview brings skilled deal-making experience. Most significantly, this acquisition expands addressable markets. Artisan continues constructing a very diversified funding platform. In consequence, shopper choices broaden considerably.

Funding Returns and Consumer Outcomes

Consumer outcomes drove asset progress in 2025. Funding returns exceeded 20% internet of charges throughout a number of methods. Particularly, world fairness methods delivered sturdy efficiency. Mounted earnings portfolios generated enticing risk-adjusted returns. Most significantly, options methods contributed meaningfully. Moreover, multi-asset portfolios carried out exceptionally. Subsequently, purchasers benefited from Artisan’s diversified platform. In consequence, inflows remained constructive all year long.

AUM and Working Revenue Progress

Artisan This fall 2025 Earnings: Belongings Underneath Administration and Working Revenue Tendencies

Diversified Product Platform Drives Progress

Artisan’s diversified platform delivered constant outcomes. World fairness methods continued attracting investor curiosity. Mounted earnings choices gained traction in rising fee environments. Most significantly, options methods generated sturdy demand. The agency’s multi-asset strategy resonates with institutional purchasers. Moreover, wealth advisors suggest Artisan options. In consequence, cross-selling alternatives expanded. Subsequently, shopper relationships deepened all year long.

2026 Outlook and Strategic Course

Administration expects continued momentum in 2026. The Grandview acquisition closes in early January 2026. This provides instantly to earnings. Moreover, market circumstances seem favorable for asset administration. Particularly, shopper demand for options stays sturdy. Most significantly, Artisan has diversified income streams. Subsequently, the outlook stays constructive. Moreover, the agency continues investing in expertise and expertise. In consequence, aggressive benefits ought to proceed increasing.

Artisan This fall 2025 Earnings: Key Takeaways

In abstract, Artisan This fall 2025 earnings confirmed sturdy momentum. Belongings underneath administration reached report ranges of $355.2 billion. Funding returns exceeded 20% internet of charges. Most significantly, the Grandview acquisition expands progress potential. Consumer satisfaction stays excessive. Trying forward, administration expects continued progress. The diversified platform ought to profit from a number of progress drivers. For extra detailed info, see our Artisan This fall 2025 earnings investor relations web page. For added company info, go to Artisan Companions official web site. For the most recent updates on funding efficiency and agency information, observe trade publications protecting asset administration.

Commercial

Source link

#Artisan #Earnings #Breakthrough #AUM #Surge #Document #355B #AlphaStreet