Clean Harbors Inc. (NYSE: CLH) earnings delivered improved results. The company reported revenue of $1.5 billion. This marked a 5% increase from the prior year’s quarter. The earnings beat expectations. Net income rose to $86.6 million. Adjusted EBITDA climbed 8% to $278.7 million. Full-year results highlighted a milestone. Revenue reached a record $6.03 billion. The company also achieved record free cash flow of $509.3 million.

Click Here to visit the Clean Harbors Inc. Investor Relations website.

Clean Harbors Q4 2025 Earnings: Financial Results

Revenue growth accelerated in the fourth quarter. Total revenues hit $1.5 billion. This compared with $1.43 billion in Q4 2024. The 5% increase exceeded market expectations. Operating income jumped to $158.4 million. This marked a 16% gain from the same period last year. So, momentum continued across the business.

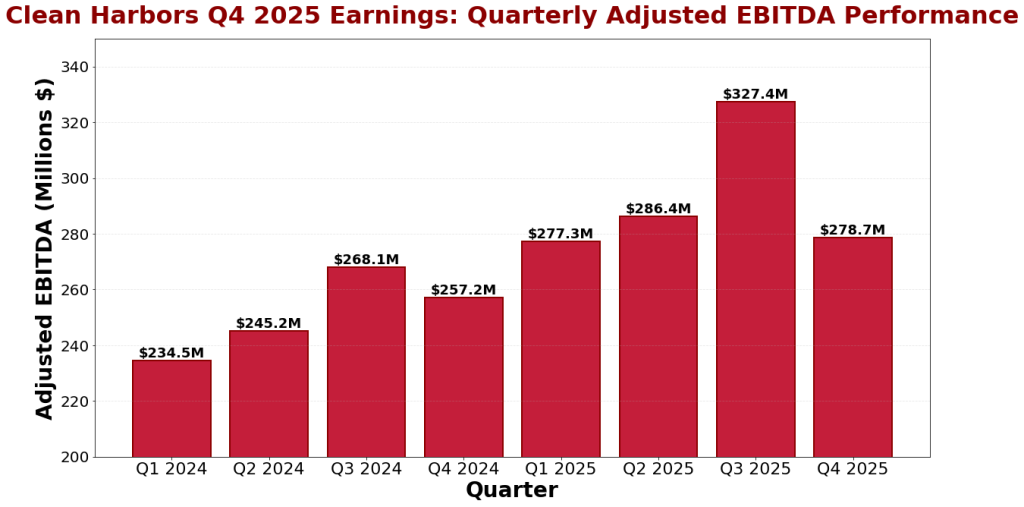

Profitability metrics improved significantly. Net income reached $86.6 million in Q4 2025. This compared with $84.0 million in Q4 2024. Adjusted EBITDA grew 8% to $278.7 million. Last year it was $257.2 million. Also, adjusted EBITDA margin expanded to 18.6%. This showed pricing power and cost discipline.

Clean Harbors Q4 2025 Earnings: Full-Year Performance

Full-year results underscored consistent execution. Also, total 2025 revenues reached $6.03 billion. This represented a 2% increase from 2024. The prior year had $5.89 billion. Full-year operating income totaled $673.4 million. This compared with $670.2 million in 2024. Plus, adjusted EBITDA grew 5% to $1.17 billion.

Cash generation proved exceptional in 2025. Operating cash flow hit $866.7 million. Adjusted free cash flow reached a record $509.3 million. This beat the prior year. Last year generated $357.9 million. The improvement came from higher adjusted EBITDA. Working capital management also aided results. So, the company generated substantial returns for shareholders.

Quarterly Revenue Performance

Figure 1: Clean Harbors Q4 2025 earnings quarterly revenue trend chart showing results from 2024 to 2025

Business Segment Performance: Growth and Margin Expansion

Environmental Services drove results this quarter. Plus, this segment delivered 6% revenue growth. Adjusted EBITDA margin expanded 50 basis points to 25.8%. Technical Services gained 8% on healthy demand. Demand for disposal and recycling services remained healthy. Project volumes climbed higher. Also, PFAS service expansion continued.

Safety-Kleen Environmental Services also performed well. In fact, revenue in this unit climbed 7%. Pricing improvements and higher volumes drove gains. Vacuum services captured market share. Incineration utilization reached 87%. Landfill volumes surged 56%. Field Services revenue jumped 13%. Large-scale emergency response projects boosted sales.

Adjusted EBITDA Performance: Operational Efficiency

Figure 2: Clean Harbors Q4 2025 earnings adjusted EBITDA quarterly performance chart demonstrating profitability growth

Strategic Growth: Capital Deployment and Acquisitions

Capital allocation remained strategic and disciplined. Plus, the company repurchased $250 million of shares in 2025. The Board expanded the buyback program by $350 million. Clean Harbors announced plans for a $130 million acquisition. The deal targets Depot Connect International businesses. The acquired operations span three states. Five locations operate in Ohio, Louisiana, and Texas.

Strategic investments in fleet expansion also began. Clean Harbors committed $50 million to vacuum truck expansion. This two-year program supports growth initiatives. The company expects a five-year payback. Cross-selling opportunities should drive higher returns. Plus, management guides to acquisition activity in 2026.

2026 Outlook: Management Guidance and Strategic Direction

Management provided full-year 2026 guidance. So, adjusted EBITDA is expected to reach $1.20-$1.26 billion. The midpoint totals $1.23 billion. This assumes profit growth continues. Adjusted free cash flow guidance ranges $480-$540 million. The midpoint stands at $510 million. So, Clean Harbors expects cash generation to remain healthy.

Near-term momentum looks positive heading into Q1 2026. Environmental Services Adjusted EBITDA should grow 4%-7%. This reflects year-over-year comparisons. Consolidated adjusted EBITDA is guided up 1%-3%. The company highlighted several growth drivers. Reshoring trends should support disposal volumes. PFAS remediation projects offer additional opportunities.

Clean Harbors Q4 2025 Earnings: Key Takeaways

- Revenue reached $1.5 billion, up 5% year-over-year.

- Operating income jumped 16% to $158.4 million.

- Adjusted EBITDA climbed 8% to $278.7 million.

- Environmental Services margin expanded to 25.8%.

- Full-year revenue hit a record $6.03 billion.

- Adjusted free cash flow reached a historic $509.3 million.

- Share repurchases totaled $250 million in 2025.

- Strategic acquisitions enhance the growth portfolio.

- $50 million invested in fleet expansion.

- 2026 guidance expects continued adjusted EBITDA growth.

Source link

#Clean #Harbors #Earnings #Soar #Momentum #Stuns #Market #AlphaStreet #News