Fabrinet (NYSE: FN) closed at $499.61, up 2.03% on the session, following the discharge of its second-quarter fiscal 12 months 2026 outcomes. The corporate’s market capitalization stood at $17.9 billion on the shut.

Newest Quarterly Outcomes (Q2FY26)

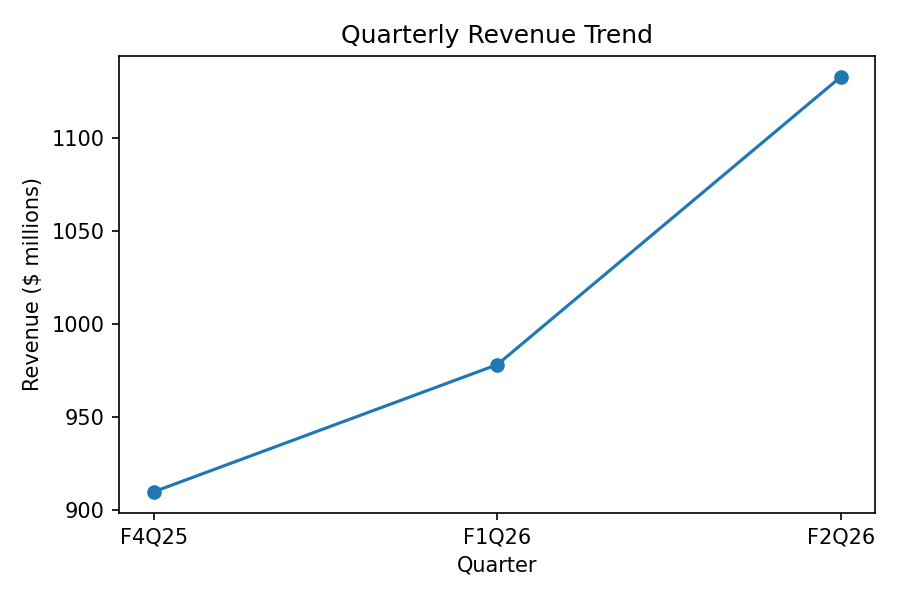

For the second quarter of fiscal 12 months 2026, Fabrinet reported consolidated income of $1,132.9 million and GAAP internet earnings of $112.6 million. Income elevated 36% from the corresponding quarter a 12 months earlier, whereas internet earnings rose 30% 12 months over 12 months.

Section Highlights:

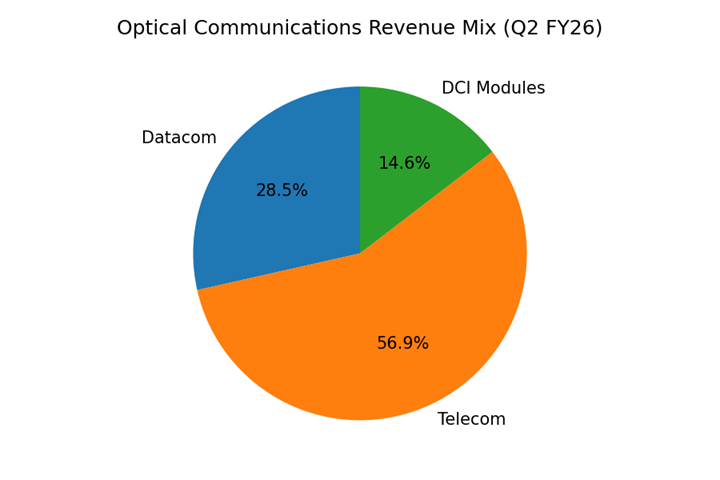

Optical communications income totaled $832.6 million for the quarter. Inside this section, datacom income was $278.1 million and telecom income was $554.4 million. Income from knowledge middle interconnect modules was reported at $142.2 million.

Non-optical communications income amounted to $300.3 million. Excessive-performance computing contributed $86.0 million, automotive merchandise generated $117.0 million, and industrial laser income was $41.4 million throughout the quarter.

Monetary Developments

For the prior full fiscal 12 months, Fabrinet reported annual income of $3.75 billion and GAAP internet earnings of $360.9 million. In contrast with the earlier fiscal 12 months, each income and revenue recorded year-over-year development. The annual pattern mirrored enlargement throughout optical communications and non-optical platforms, with development reported in telecom, datacom, and high-performance computing packages. No materials contraction was reported within the firm’s disclosed finish markets throughout the interval.

Enterprise & Operations Replace

In the course of the quarter, Fabrinet continued work on capability enlargement initiatives throughout its manufacturing footprint. The corporate stated building of Constructing 10, a deliberate 2 million sq. foot facility, remained on schedule, with roughly 250,000 sq. toes anticipated to be prepared for manufacturing by mid-calendar 2026. Administration additionally reported ongoing capability additions on the Pinehurst campus and continued qualification of automated manufacturing traces, notably for high-performance computing packages. Operational updates throughout the quarter targeted on manufacturing readiness, workforce coaching, and provide chain coordination to assist buyer demand.

M&A or Strategic Strikes

The corporate didn’t announce any acquisitions, divestitures, or materials strategic transactions throughout the quarter. No definitive agreements or institutionally reported discussions associated to mergers or asset gross sales had been disclosed within the reviewed supplies.

Fairness Analyst Commentary

Institutional analysis commentary referenced in public summaries famous continued income development throughout telecom, datacom, and high-performance computing platforms. Analysts highlighted the contribution from knowledge middle interconnect modules and rising volumes in high-performance computing packages. The commentary targeted on reported figures and operational updates with out issuing funding suggestions or valuation targets.

Steering & Outlook — what to observe for

Wanting forward, what to observe for contains the corporate’s issued income steerage vary for the third quarter of fiscal 12 months 2026, set between $1.15 billion and $1.20 billion. Buyers are additionally monitoring progress on facility readiness at Constructing 10, qualification timelines for added automated manufacturing traces, and disclosures associated to capital expenditure and overseas change hedging. Trade demand circumstances throughout optical and non-optical platforms stay a key space of consideration.

Efficiency Abstract

Fabrinet shares rose 2.03% on the shut. Second-quarter income was $1,132.9 million, with GAAP internet earnings of $112.6 million. Optical communications and high-performance computing had been the biggest reported contributors, whereas capability enlargement remained a central operational focus.

Commercial

Source link

#Fabrinet #shares #climb #FY26 #income #revenue #rise #12 months #12 months #AlphaStreet